georgia ad valorem tax out of state

Ad valorem tax georgia. Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax.

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

If itemized deductions are also.

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)

. The two changes that apply to most vehicle transactions are. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020. GA Code 48-5-47 65 Years of Age and Low Income Exemption Individuals 65 Years of Age and Older May Claim a 4000 Exemption.

Beginning March 1 2013 state and local sales tax will no longer apply to. Rental tax and lodging tax. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

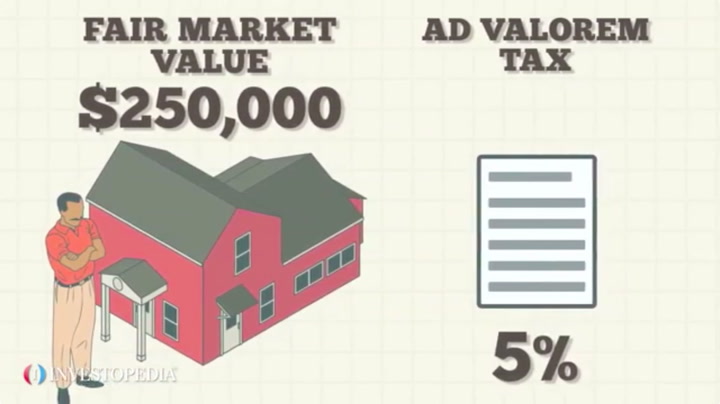

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Use Ad Valorem Tax Calculator. Ad valorem tax for state purposes will be due on the assessed value of land that exceeds the 10 acre limitation.

Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT. How does it work. Local state and federal government websites often end in gov.

Sorry for your misfortune. Learn how Georgias state tax laws apply to you. The Latin phrase ad valorem can be commonly defined as according to value In the state of Georgia individuals who own a motor vehicle are required to pay a one-time ad valorem tax commonly.

If your registration is paid after your birthday due date then you are responsible for all applicable late. The state of georgia passed a law in 2013 that completely. The TAVT rate will be lowered to 66 of the.

Title Ad Valorem Tax TAVT became effective on March 1 2013. Owners of vehicles that fit this category can use the DORs Title Ad Valorem Tax Calculator tool to calculate their. TAVT is a one-time tax that is paid at the time the vehicle is titled.

Title Ad Valorem Tax TAVT Changes Effective January 1 2020. As a result the annual vehicle ad valorem tax sometimes called the birthday tax is being changed to a state and local title ad valorem tax or TAVT. Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioners office.

The GDVS can only verify the status of a. And is paid every time vehicle ownership is transferred or a new resident registers the vehicle in Georgia for the first time. Two common vehicle taxes implemented in this state are the Title Ad Valorem Tax and the Annual Ad Valorem Tax.

This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. For the answer to this question we consulted the Georgia Department of Revenue. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. In this example multiply 40000 by 066 to get 2640 which makes the total purchase price 47640. You change-a the title you pay-a the tax.

As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase. For context Georgia charges a 7 Ad Valorem tax on obtaining a Georgia registration and title 7 of the fair market value. Title Ad Valorem Tax TAVT became effective on March 1 2013.

How does it work. Currently 50 out of the 1079 zip codes in Georgia. The property taxes levied means the taxes charged against taxable property in this state.

If you buy a car out of state and register it in Georgia then there is a 4 state sales tax instead of the TAV Tax. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Use Ad Valorem Tax Calculator.

Beginning March 1 2013 state and local. Two common vehicle taxes implemented in this state are the Title Ad Valorem Tax and the Annual Ad Valorem Tax. This tax is based on the value of the vehicle.

The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. This tax law Annual Ad Valorem Tax is calculated by the vehicle values set by the Georgia Department of Motor Vehicle Division and multiplied by the mill rate set by the governing authorities state school county water authority. This calculator can estimate the tax due when you buy a vehicle.

The tax must be paid at the time of sale by Georgia residents or within six months of. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

T-146 Georgia IRP Exemption to State and Local Ad ValoremTitle Ad Valorem Tax Fee Application T-146 Georgia IRP Exemption to State and Local Ad Valorem. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Currently 50 out of the 1079 zip codes in Georgia.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Some of the taxes levied may not be collected for various reasons assessment errors insolvency bankruptcy etc. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

As a result the annual vehicle ad valorem tax sometimes called the birthday tax is being changed to a state and local title ad valorem tax or TAVT. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

You can calculate the Title Ad Valorem Tax by finding the fair market value of the vehicle and multiplying it by 66. I want to buy a car in a different state which has also has a sales tax on cars and bring it to Georgia and then get the registration and title there but do not want to double my tax payment. Motor vehicles registered in Georgia.

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

We Rated Every State For Taxes Based On State Income Taxes Local Sales Taxes Gas Taxes And More Find Out Where Your State Ranks Usa Map Map Gas Tax

Cypress Texas Property Taxes What You Need To Know

Business Personal Property Tax Return Augusta Georgia Property Tax Personal Property Tax Return

The Shutdown Of Businesses Across The Country Is Casting A Pall Over A Segment Of The 3 9 Trillion Municipal Bond Market That Had B Sales Tax Tax Filing Taxes

Georgia Used Car Sales Tax Fees

Property Tax Map Tax Foundation

State Tax Levels In The United States Wikipedia

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Payment Mortgage

Here Are The Most Tax Friendly States For Retirees

Property Taxes Property Tax Analysis Tax Foundation

The Hidden Costs Of Owning A Home

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

How To Find A Georgia Employer Identification Number Property Tax Last Will And Testament Tax

State Corporate Income Tax Rates And Brackets Tax Foundation